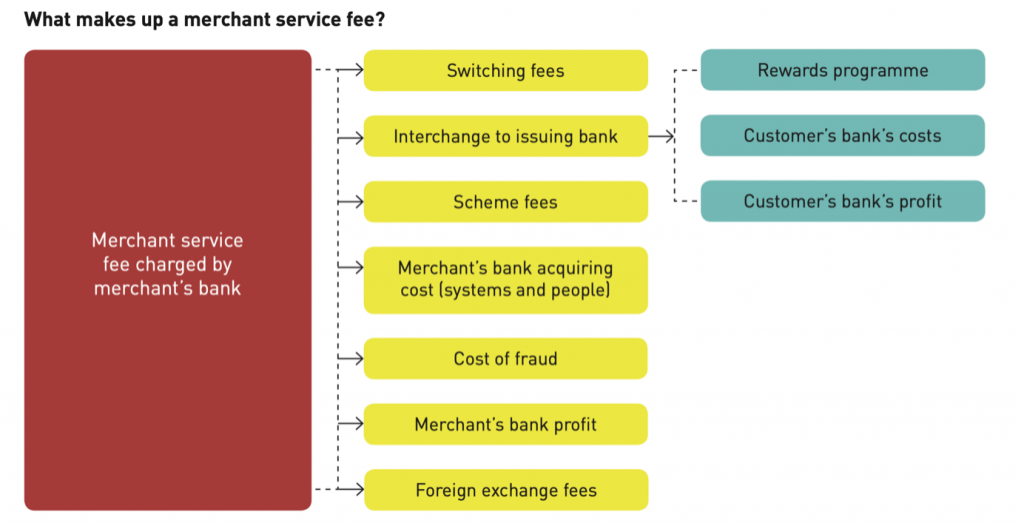

Merchant fees for credit and contactless debit cards are a big cost for business. Retail NZ has been campaigning for cheaper merchant fees for some time. The Government responded to this by passing the Retail Payment System Act 2022. However, more changes are needed to give retailers and customers greater transparency over the costs, and to ensure New Zealand stays up to date with international innovations in payments technology.

For further information, please contact [email protected].